House Rent Claim Rules . as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. Some of the most prominent rules pertaining to house rent allowance are mentioned below. 415, renting residential and vacation property. If you receive rental income for the use of a dwelling unit, such. This is applicable under section. explore a comprehensive guide on house rent allowance (hra), covering rules, exemptions, and smart strategies for maximising tax savings. what is hra in salary? Hra is a part of an employee’s. Hra is an allowance provided by the employer to the employee to cover the cost of living in rented accommodation. what are the exemption rules of hra.

from www.peterainsworth.com

explore a comprehensive guide on house rent allowance (hra), covering rules, exemptions, and smart strategies for maximising tax savings. Hra is a part of an employee’s. 415, renting residential and vacation property. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. what are the exemption rules of hra. If you receive rental income for the use of a dwelling unit, such. what is hra in salary? Hra is an allowance provided by the employer to the employee to cover the cost of living in rented accommodation. house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. This is applicable under section.

Rent House Rules

House Rent Claim Rules 415, renting residential and vacation property. what is hra in salary? house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. Hra is an allowance provided by the employer to the employee to cover the cost of living in rented accommodation. Hra is a part of an employee’s. This is applicable under section. what are the exemption rules of hra. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. If you receive rental income for the use of a dwelling unit, such. explore a comprehensive guide on house rent allowance (hra), covering rules, exemptions, and smart strategies for maximising tax savings. 415, renting residential and vacation property. Some of the most prominent rules pertaining to house rent allowance are mentioned below.

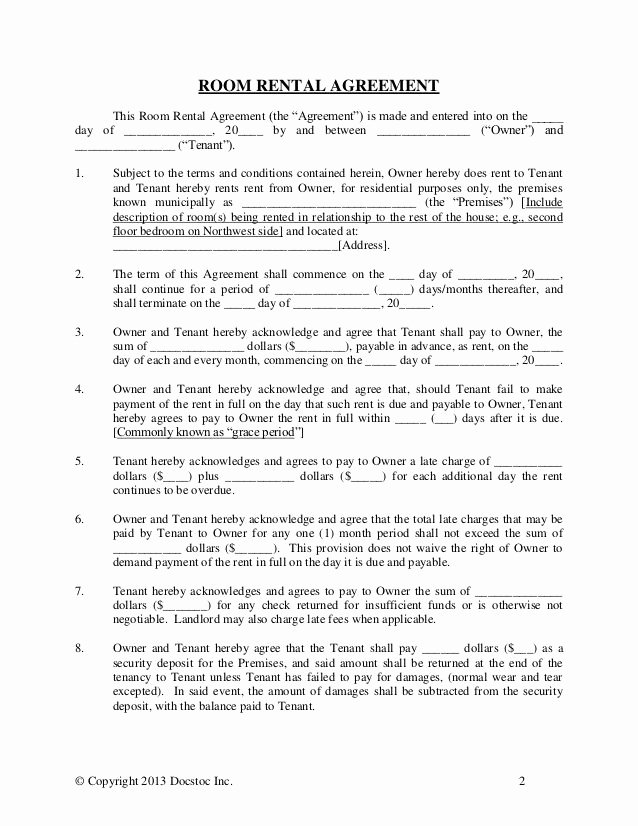

From www.dexform.com

Sample Rental Rules/ Contract in Word and Pdf formats House Rent Claim Rules what are the exemption rules of hra. This is applicable under section. what is hra in salary? Hra is an allowance provided by the employer to the employee to cover the cost of living in rented accommodation. Hra is a part of an employee’s. explore a comprehensive guide on house rent allowance (hra), covering rules, exemptions, and. House Rent Claim Rules.

From www.bizresourcecenter.com

Rental Homes Reducing Risk and Preventing Claims Business Resource Center House Rent Claim Rules Some of the most prominent rules pertaining to house rent allowance are mentioned below. house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. explore a comprehensive guide on house rent allowance (hra), covering rules, exemptions, and smart strategies for maximising tax savings. Hra is a part. House Rent Claim Rules.

From www.signnow.com

Rental Rules and Regulations Form Complete with ease airSlate SignNow House Rent Claim Rules what is hra in salary? This is applicable under section. Some of the most prominent rules pertaining to house rent allowance are mentioned below. 415, renting residential and vacation property. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. explore a comprehensive guide on house rent allowance. House Rent Claim Rules.

From www.pinterest.com.au

House rules for lodgers Renting Out A Room, Renting A House, House Rental, Word Design, Design House Rent Claim Rules what is hra in salary? If you receive rental income for the use of a dwelling unit, such. Some of the most prominent rules pertaining to house rent allowance are mentioned below. what are the exemption rules of hra. 415, renting residential and vacation property. This is applicable under section. explore a comprehensive guide on house rent. House Rent Claim Rules.

From www.peterainsworth.com

Rent House Rules House Rent Claim Rules house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. If you receive rental income for the use of a dwelling unit, such. Some of the most prominent rules pertaining to house rent allowance are mentioned below. Hra is an allowance provided by the employer to the employee. House Rent Claim Rules.

From carajput.com

How to claim HRA allowance, House Rent Allowance exemption House Rent Claim Rules Hra is an allowance provided by the employer to the employee to cover the cost of living in rented accommodation. If you receive rental income for the use of a dwelling unit, such. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. 415, renting residential and vacation property. . House Rent Claim Rules.

From vacationhomehelp.com

Vacation Rental House Rules Template Download PDF House Rent Claim Rules If you receive rental income for the use of a dwelling unit, such. 415, renting residential and vacation property. Some of the most prominent rules pertaining to house rent allowance are mentioned below. house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. as a taxpayer, you. House Rent Claim Rules.

From emkvinesdal.blogspot.com

HOUSE RULES EM KVINESDAL House Rent Claim Rules This is applicable under section. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. explore a comprehensive guide on house rent allowance (hra), covering rules, exemptions, and smart strategies for maximising tax savings. house rent allowance (hra) is paid by an employer to employees as a part. House Rent Claim Rules.

From studylib.net

HOUSE RULES Room Rent Wageningen House Rent Claim Rules Hra is a part of an employee’s. Some of the most prominent rules pertaining to house rent allowance are mentioned below. house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. 415, renting residential and vacation property. This is applicable under section. If you receive rental income for. House Rent Claim Rules.

From www.edrafter.in

Rent Agreement For HRA How To Claim the Benefits House Rent Claim Rules as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. explore a comprehensive guide on house rent allowance (hra), covering rules, exemptions, and smart strategies for maximising tax savings. 415, renting residential and vacation property. This is applicable under section. Hra is an allowance provided by the employer to. House Rent Claim Rules.

From studylib.net

House Rules At Home Apartments House Rent Claim Rules 415, renting residential and vacation property. what is hra in salary? Some of the most prominent rules pertaining to house rent allowance are mentioned below. Hra is a part of an employee’s. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. house rent allowance (hra) is paid. House Rent Claim Rules.

From webintroducer.com

House Rent Allowance Claim For Tax Calculation Know Rule In Financial Year 2023 House Rent Claim Rules Hra is a part of an employee’s. Some of the most prominent rules pertaining to house rent allowance are mentioned below. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. what is hra in salary? house rent allowance (hra) is paid by an employer to employees as. House Rent Claim Rules.

From e-startupindia.com

How to claim House Rent Allowance Exemption in ITR Filing House Rent Claim Rules 415, renting residential and vacation property. Hra is a part of an employee’s. house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. Hra is an allowance provided by the employer to the employee to cover the cost of living in rented accommodation. This is applicable under section.. House Rent Claim Rules.

From www.peterainsworth.com

Rent House Rules House Rent Claim Rules what is hra in salary? 415, renting residential and vacation property. explore a comprehensive guide on house rent allowance (hra), covering rules, exemptions, and smart strategies for maximising tax savings. This is applicable under section. Hra is a part of an employee’s. If you receive rental income for the use of a dwelling unit, such. what are. House Rent Claim Rules.

From www.pinterest.com

8 House Rules Every Landlord Should Explain to Tenants Being a landlord, House rules, Rules House Rent Claim Rules house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. Hra is a part of an employee’s. 415, renting residential and vacation property. what is hra in salary? This is applicable under section. as a taxpayer, you can claim tax benefits on the amount you pay. House Rent Claim Rules.

From www.printablee.com

Household Rules 10 Free PDF Printables Printablee House Rent Claim Rules 415, renting residential and vacation property. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. what are the exemption rules of hra. Hra is a part. House Rent Claim Rules.

From www.scribd.com

Rent House Rules Renting Leasehold Estate House Rent Claim Rules This is applicable under section. what are the exemption rules of hra. as a taxpayer, you can claim tax benefits on the amount you pay as rent for accommodation each year. Hra is an allowance provided by the employer to the employee to cover the cost of living in rented accommodation. explore a comprehensive guide on house. House Rent Claim Rules.

From www.wintwealth.com

HRA or House Rent Allowance Deduction & Calculation House Rent Claim Rules If you receive rental income for the use of a dwelling unit, such. house rent allowance (hra) is paid by an employer to employees as a part of their salary to meet the accommodation. This is applicable under section. Hra is an allowance provided by the employer to the employee to cover the cost of living in rented accommodation.. House Rent Claim Rules.